postmates tax form online

Postmates keep 20 of this delivery fee and drivers get the rest as well as can keep 100 of the tip amount they earn. 5 off your subtotal applied as a discount to the Service Fee.

How To Get Your 1099 Form From Postmates

Many drivers have reported getting tipped simply because they helped customers fill out their confirmation forms.

. Savings based on the Delivery Fee savings for orders placed over last member cycle excluding the cost of the membership. Before I go any further let me make this clear. How To Get Postmates Tax 1099 Forms_____New Project.

Typically you should receive your 1099 form before January 31 2021. Form 1099 is actually a collection of forms that report non-wage income including self-employment income to the IRS. 1099 forms are sent to freelancers or contractors by the person or company that paid them.

Postmates has joined Uber Eats which means customers and delivery requests have switched to the Uber app as of June 7 2021. How to Get 1099 from Postmates. Read on for more details.

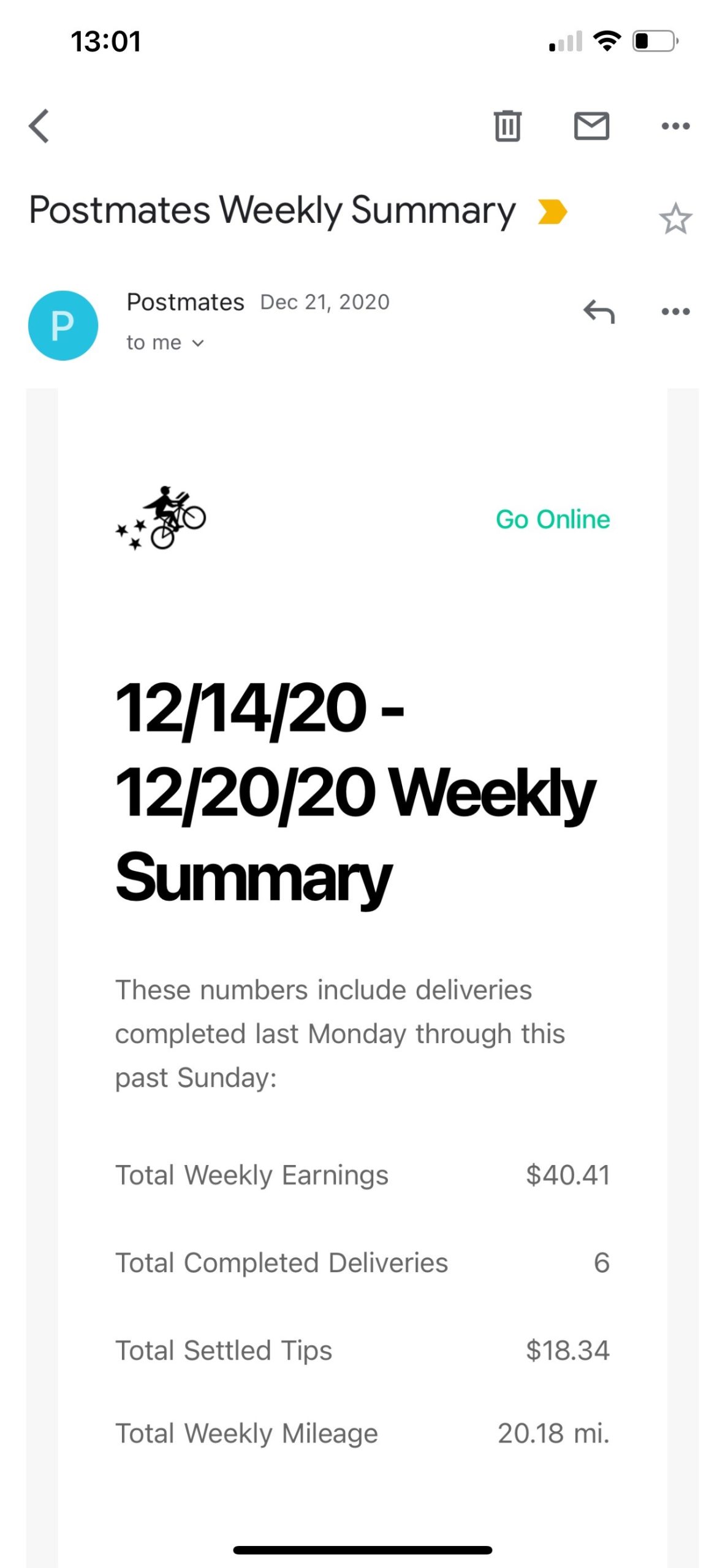

So lets talk about 1099s today. Postmates will send you this form if you made over 600 in a year. Its the end of January.

The most important box on this form that youll need to use is Box 7 Non-employee Compensation. Getting the form is the easy part. There are many IRS 1099 forms but our guide will only review the most relevant ones for your Postmates taxes.

Its pretty generous so if you drive upwards of 5000 miles per year for work and dont have a gas-inefficient car then youll probably get a larger. IRS Tax Forms For A Postmates Independent Contractor. Your earnings exceed 600 in a year.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. The standard mileage rate for 2017 is 535 cents per mile and its calculated to include the average cost of gas car payments car insurance maintenance and other vehicle expenses. While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC for you if.

The tax forms you get as a Postmates driver. Postmates drivers for instance will ultimately receive their forms from Uber since Postmates was. Unlimited free deliveryonly for Unlimited members.

From how to pay your postmates taaxes to what write offs you can claim with postmates. Postmates will send you this form if you made over 600 in a year. By linking your Uber Eats account your Postmates delivery account should migrate with you and be displayed in-app on your Uber Profile app.

Independent contractors are generally considered self-employed and report profits and losses on form 1040 Schedule C. Its tax time isnt it. You will also be assessed a Self-Employment tax Social Security and Medicare that calculated at a roughly 15 tax rate.

Ad Free software fills out tax forms IRS free file program participant. It will look something like this. According to Postmates if you dont meet this requirement you wont receive a 1099-MISC.

The best way to figure out if you owe quarterly taxes is to fill out Form 1040-ES or use an online tax calculator to estimate how much income youll have this year and how much youll owe in taxes. If you earned more than 600 youll receive a 1099-NEC form. This is not meant to be a talk about taxes.

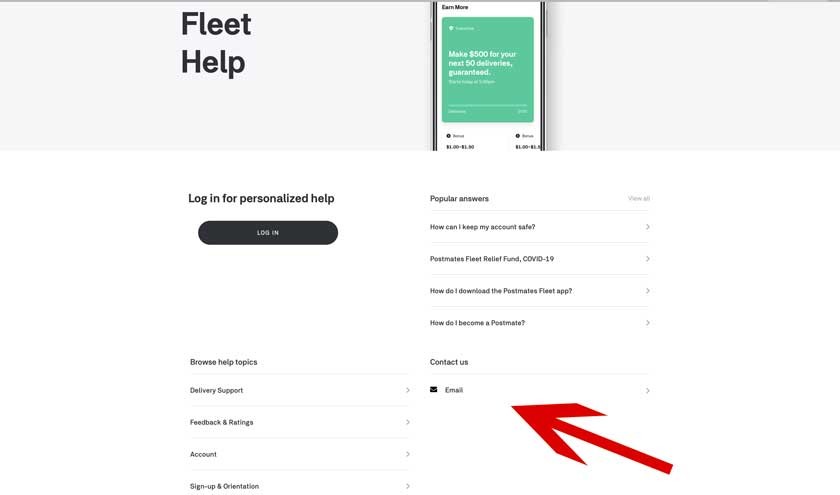

I can no longer go online in my Postmates Fleet app. Here is the link youll need to request a 1099 from Postmates. Your taxable income from self-employment will be taxed at ordinary income tax rates.

Since taxes arent withheld from your Postmates income its possible you need to pay taxes quarterly. How To Get Postmates Tax 1099 Forms Youtube Postmates Taxes The Complete Guide Net Pay Advance The Ultimate Guide To Taxes For Postmates Stride Blog Postmates 1099 Tax Filing The Complete Guide. Get Your Maximum Refund With TurboTax.

Postmates Tax Form 1099. A 1099 form is an information return that shows how much you were paid from a business or client that was not your employer. This means that if you work for Postmates you have to track your own taxes.

In this Video I try my best to explain Postmates taxes. Getting the form is the easy part. You can change auto-renew settings in the Unlimited section of your Postmates app.

Read on for more details. You can make many deductions through your work effectively reducing your taxes. With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever.

Get Your Max Refund Today. As a Postmates delivery driver youll receive a 1099 form. Postmates tax form online Saturday March 19 2022 Edit.

You are starting to get your 1099 forms from Grubhub Doordash Postmates and Uber Eats. As a Postmates independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filings. The standard mileage rate for 2017 is 535 cents per mile and its calculated to include the average cost of gas car payments car insurance maintenance and other vehicle expenses.

IRS Tax Forms For A Postmates Independent Contractor. As a Postmates delivery driver youll receive a 1099 form. As you may already know youll need a 1099-MISC form to do that.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Postmates will send you a 1099-NEC form to report income you made working with the company. IRA Tax Forms for All Types of Less - Used Tax Forms.

Not including taxes and fees. As earlier said you can find many of these tricks and hacks on Postmates Drivers groups. Try it free with a 7-day free trial cancel anytime.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. TurboTax will do all the calculations for you based upon your Schedule C. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

File Your Federal And State Taxes Online For Free. Like we said Postmates will send a physical form to your home address if your earnings exceed 600.

Chipotle Sign Saying Staff Walked Out Goes Viral Plus 22 More Similar Signs From Other Us Businesses Sign Quotes Sayings Return To Work

Postmates 1099 Taxes The Last Guide You Ll Ever Need

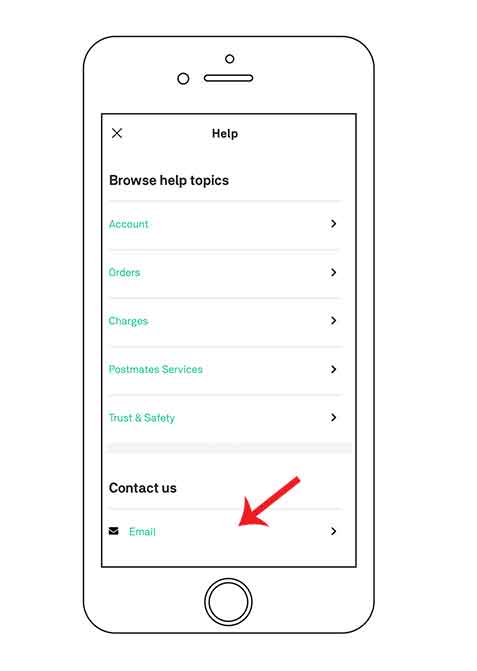

Postmates Customer Service 3 Ways To Contact Postmates Support

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Get Postmates Tax 1099 Forms Youtube

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates Customer Service 3 Ways To Contact Postmates Support

Postmates Taxes The Complete Guide Net Pay Advance

Postmates Customer Service 3 Ways To Contact Postmates Support

Complete Guide To Postmates Tipping Etiquette Maid Sailors

Postmates Taxes 101 Filing Postmates Taxes For The End Of The Year Youtube

4 Easy Ways To Contact Postmates Driver Customer Support

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How To Get Your 1099 Form From Postmates

4 Easy Ways To Contact Postmates Driver Customer Support

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How To Get Your 1099 Form From Postmates